Long Term Care insurance today is not what it was 20 years ago.

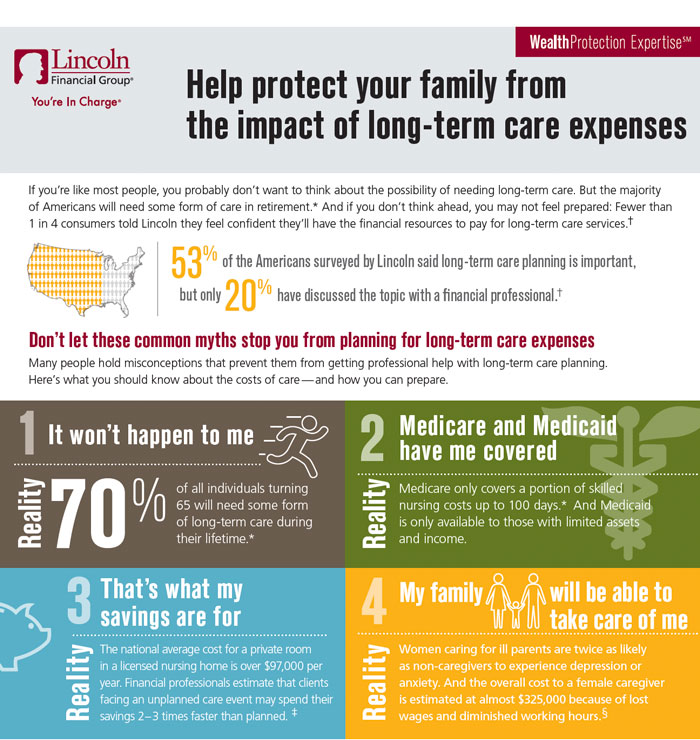

It is important to be an advocate for your client to ensure they can maintain the lifestyle they expect even when their health tries to take them down a different path. Consumers spend majority of their lives preparing for retirement and one unexpected LTC situation can destroy a financial plan in as little as one year. LTC claims effect ore than just a financial plan too, it can become a divide in a family which can cause resentment, arguments, and declining health of the caregiver. At Oberlin Marketing we understand the importance of keeping a book of business growing through family generations, and this is a great way to help you find new success.

LTC Basics

There are core basics to know about Long Term Care protection that can help you be prepared to identify your opportunities and the types of coverage that are available. Traditional LTC has been through many changes and the hybrid option is one of the fastest growing in the industry so it can be intimidating at first, but we are here to help make it easy. Before you know it, you will be the specialist everyone refers new clients to.

LTC Carriers

We have access to all the main LTC carries in the market today with competitive commissions. The partnership with our carriers is invaluable and can help you in numerous ways. Each has their own strengths to make sure we find the best fit you your client every time. Any sustainable business requires the right relationships.

There are some carriers you must register with to access their site.

*Additional carriers offer the LTC rider on life insurance policies which you will find on our Life Insurance page.

Sales & Resources

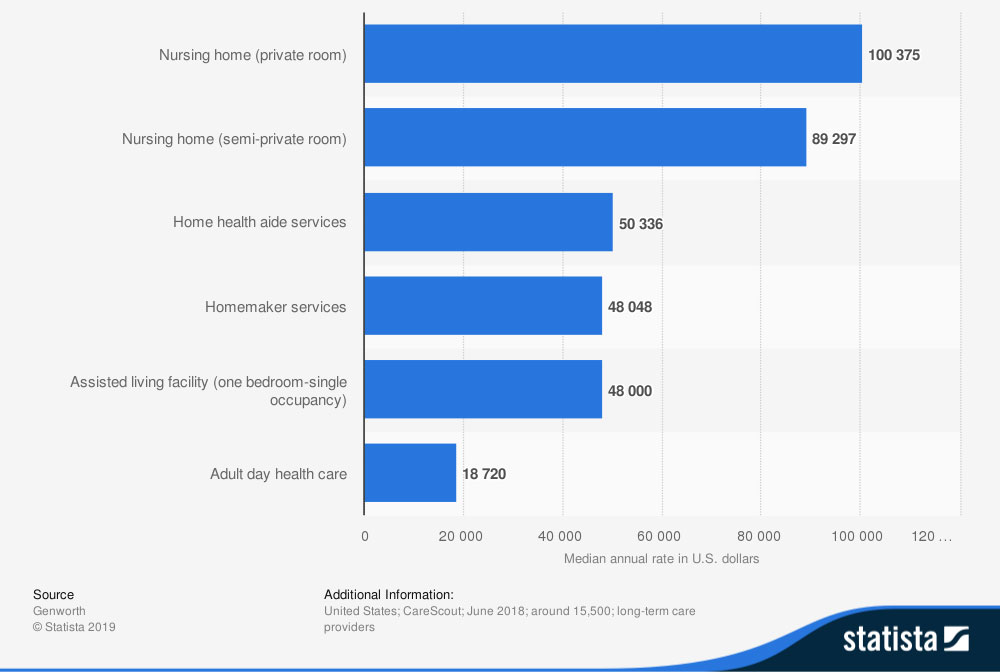

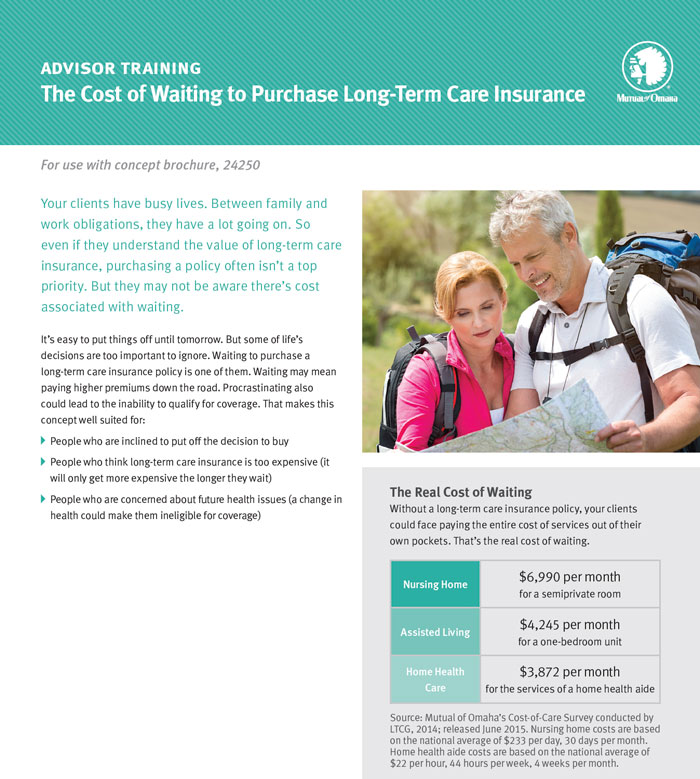

As a producer your goal is to assist your client with their decision and then to act on that decision. Many clients believe they need to wait for “better timing” but we all know in the world of insurance that just means higher costs with potentially loss of insurability.

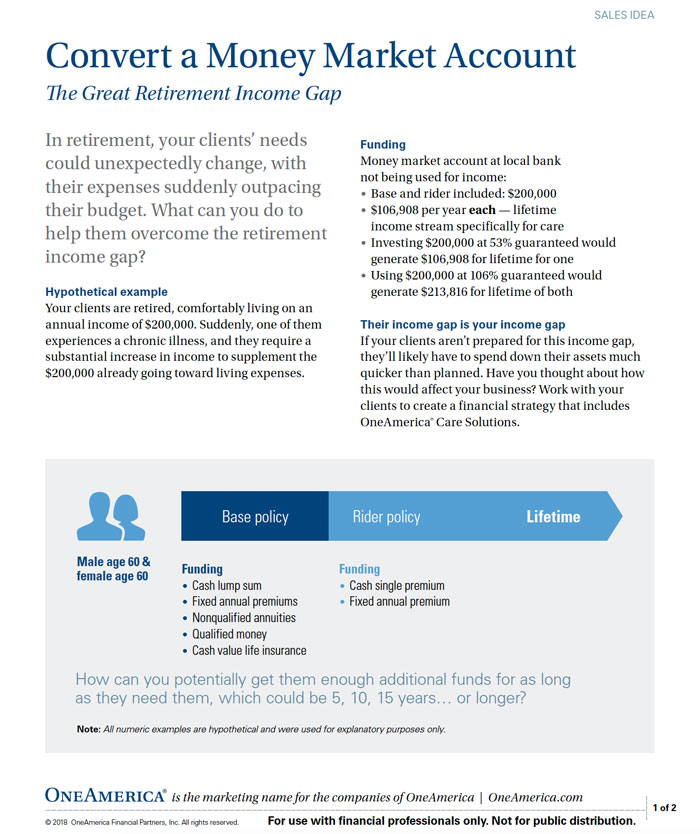

Convert a Money Market for LTC Protection? One America offers multiple resources to show clients how to prepare for the Great Income Gap.

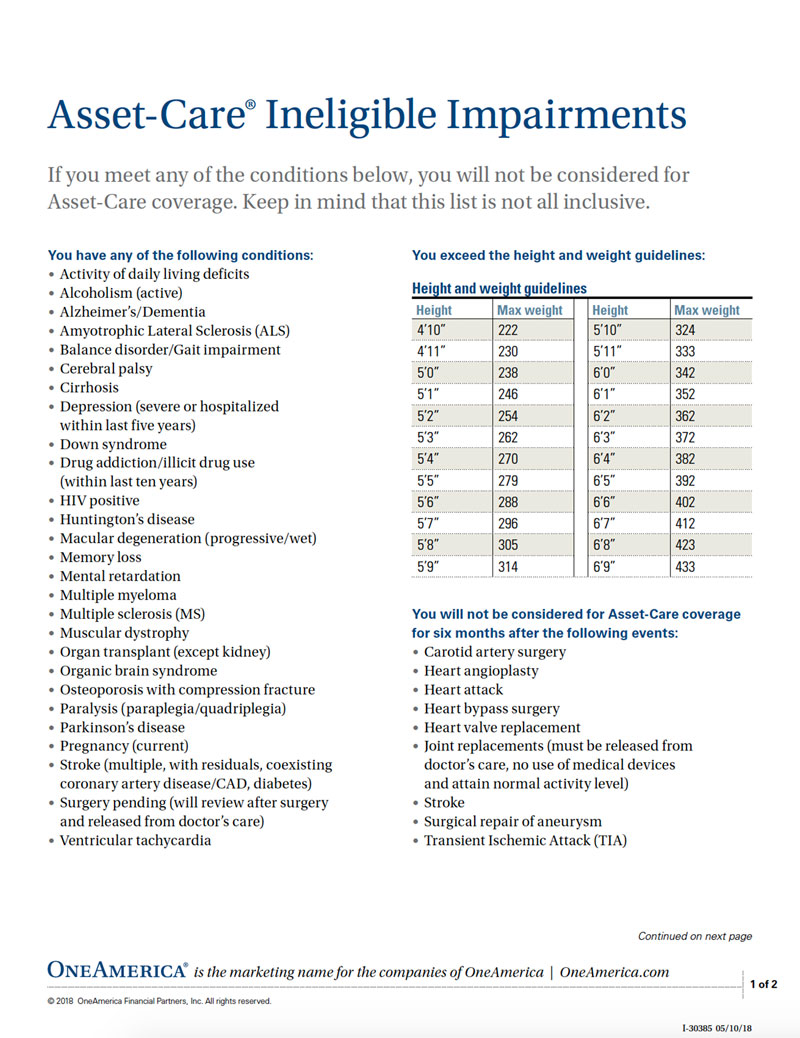

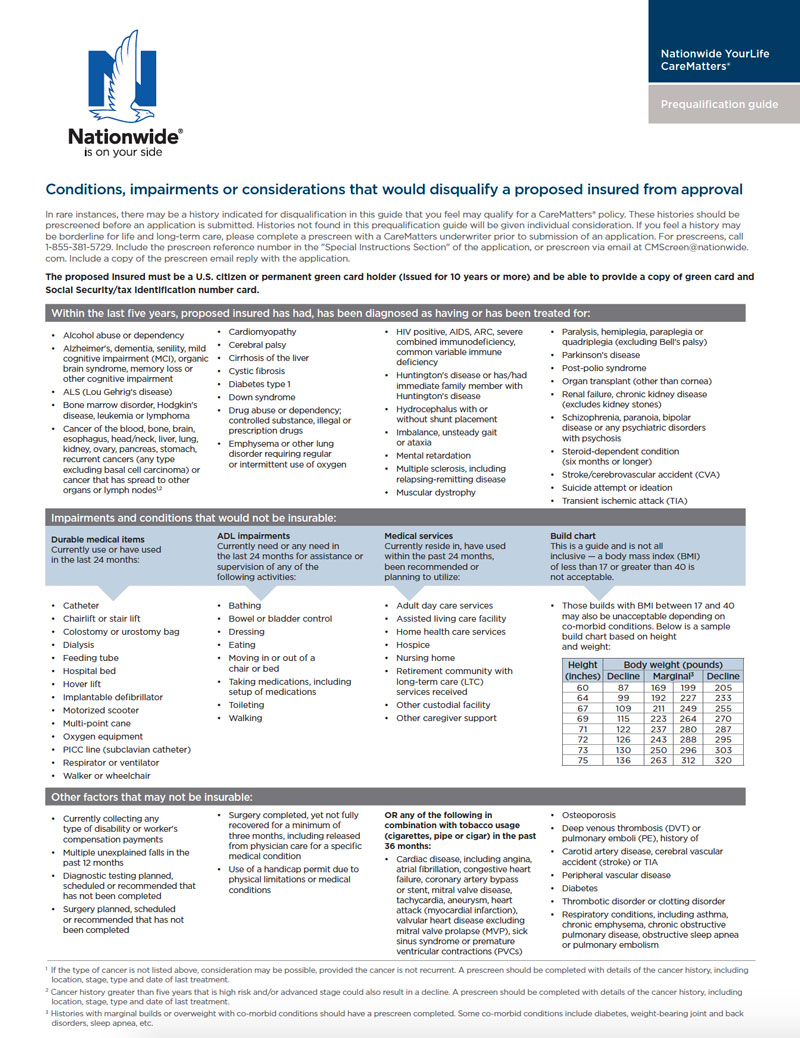

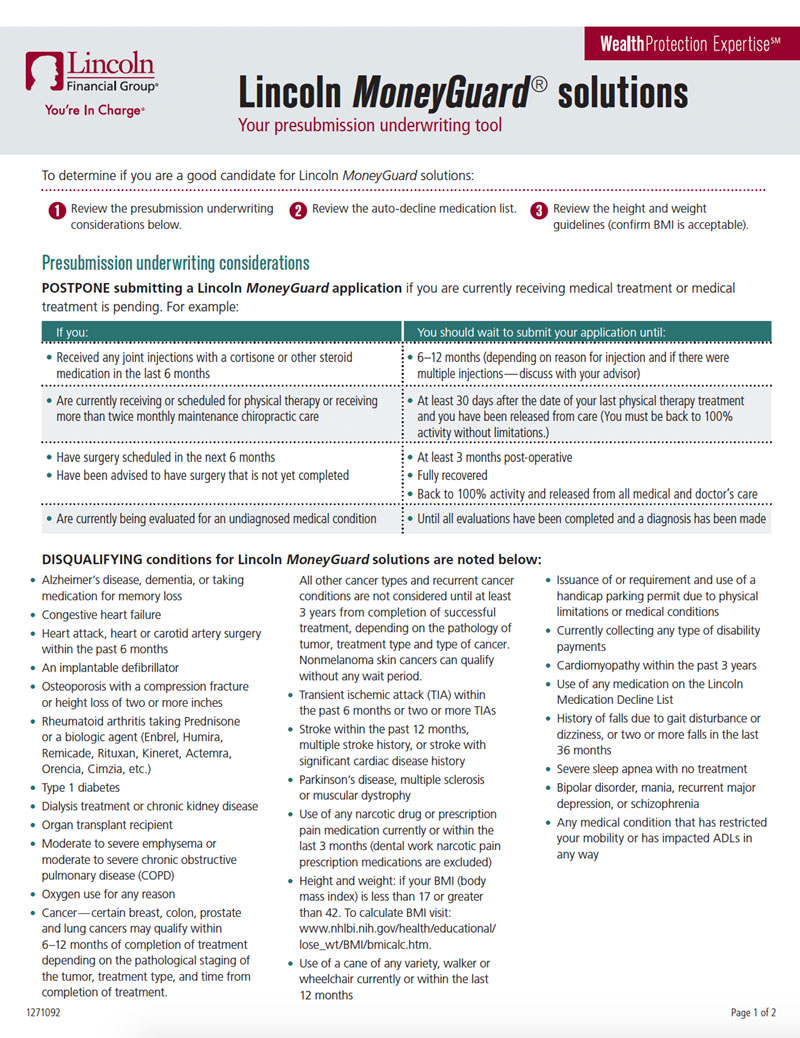

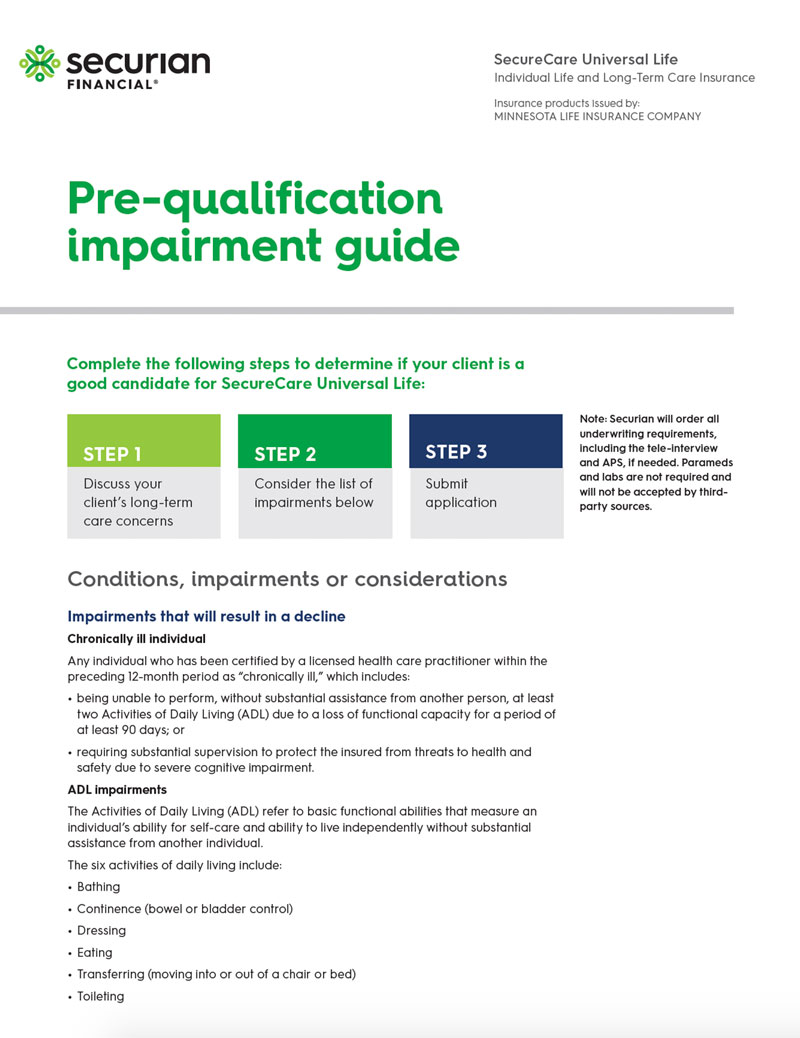

Underwriting

Long Term Care underwriting is different than Life Insurance. Some impairments that are not favorable for mortality have minimal impact on morbidity. We are here to work through information before the application to create a positive experience for your client. Part of finding the right plan is aligning expectations in the beginning.